Save money with

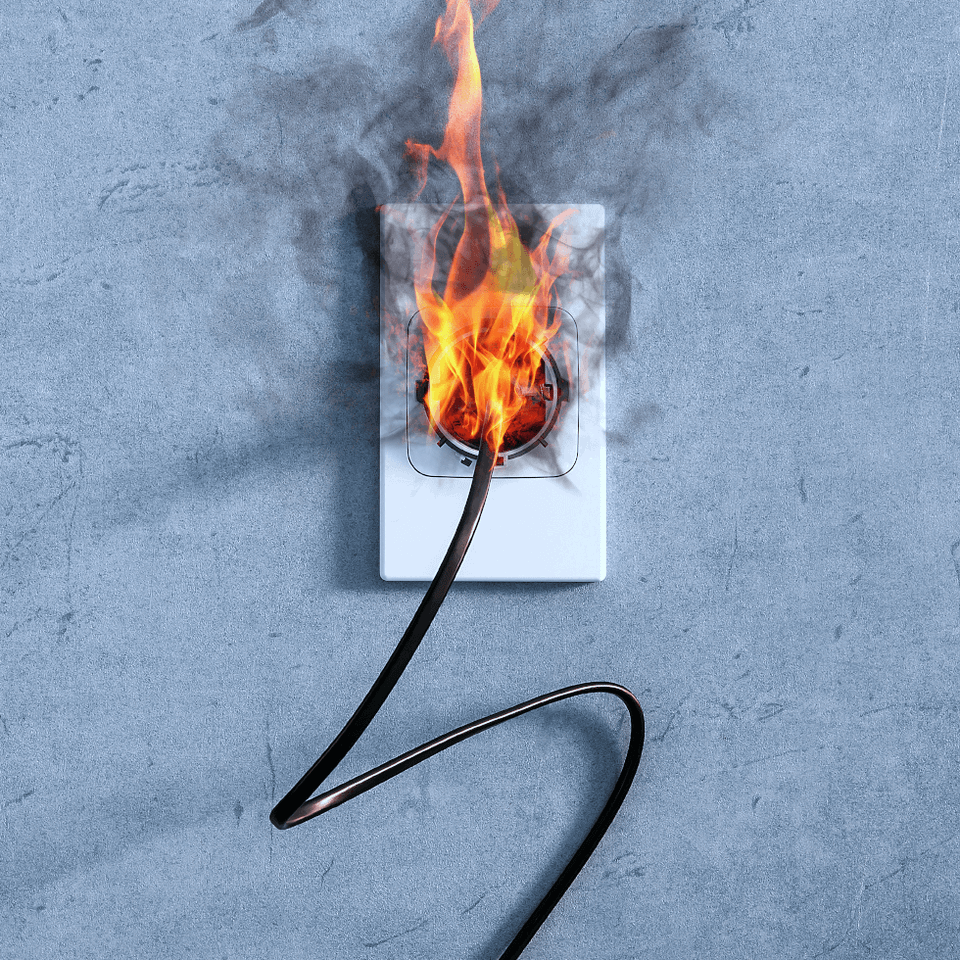

dwelling fire insurance

Homeowners insurance offers a broad range of protections for a property, but can be expensive if you have multiple properties you need to insure. If you are leasing homes, you should consider dwelling fire insurance to protect your property.

Dwelling fire insurance will cover all named perils, whereas homeowners will cover all perils but named exclusions. It is a specifically-tailored type of home insurance. These policies can be written for the actual cash value of the property or for replacement cost.

Dwelling fire insurance will cover all named perils, whereas homeowners will cover all perils but named exclusions. It is a specifically-tailored type of home insurance. These policies can be written for the actual cash value of the property or for replacement cost.