Protect your

business assets

from damage or loss

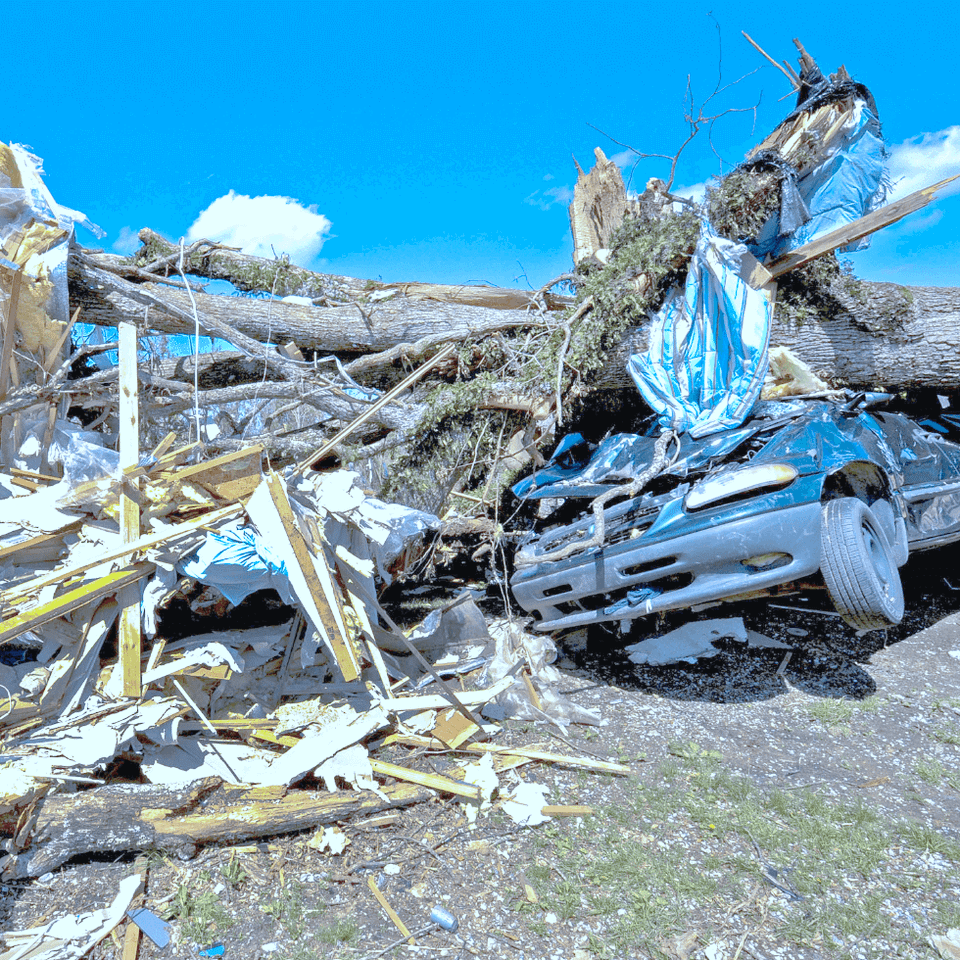

Commercial property insurance covers your business assets. Loss or damage to your physical location, merchandise, papers, money, and other valuable items can be reimbursed so you can get back on your feet. Theft, fire, natural disasters, and more can happen at any time.

Be prepared in the event something damaging happens to your business. Insurance protects everyone from financial fallout from massive disasters or accidents, including small businesses and large corporations.

The cost of commercial property insurance is usually based on the required amounts of coverage set by your insurance company.

Be prepared in the event something damaging happens to your business. Insurance protects everyone from financial fallout from massive disasters or accidents, including small businesses and large corporations.

The cost of commercial property insurance is usually based on the required amounts of coverage set by your insurance company.